ERPNext has a comprehensive Payment Process. Payments can happen in following scenarios:

1. Purchase Invoice

2. Expense Claim

3. Payment Request

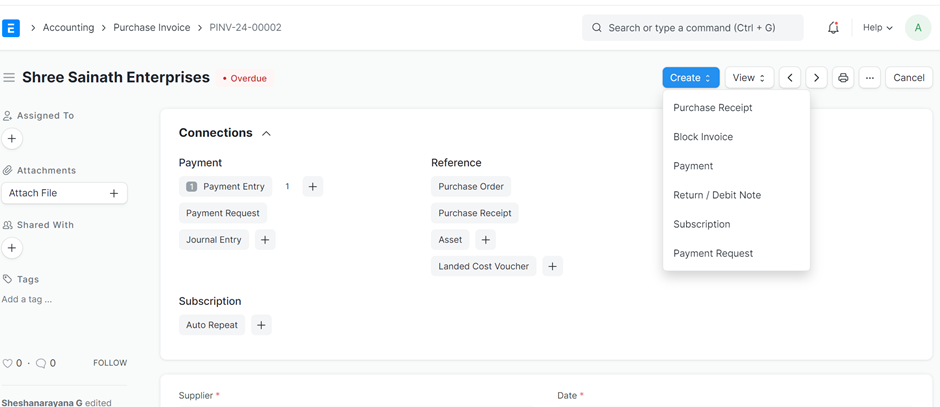

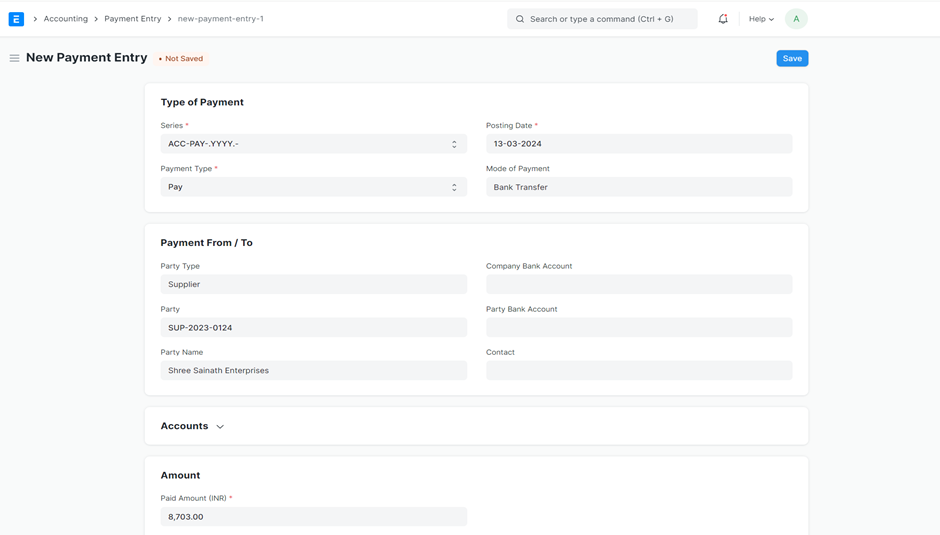

1. Purchase Invoice: The standard process has Payment option once Purchase Invoice is captured in the system after confirming the Purchase Receipt in ERP for the accepted quantity. From the Purchase Invoice screen, once the document is submitted, Payment transaction can be executed as shown below:

All the respective values will flow from the Purchase Invoice for the accepted quantity. Under accounting appropriate Bank account has to be selected. The same can be configured in settings for all Creditors.

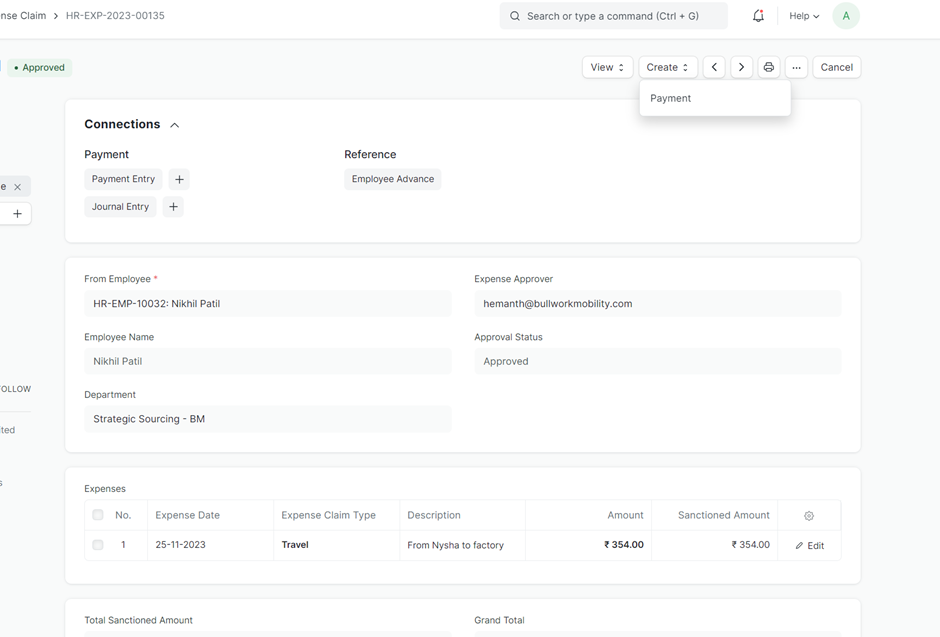

2. Expense Claim: Similar process exist for expense claim. From the approved Expense claim Payment option can be selected.

Here again the Bank account from which the Payment is made for expenses can be configured.

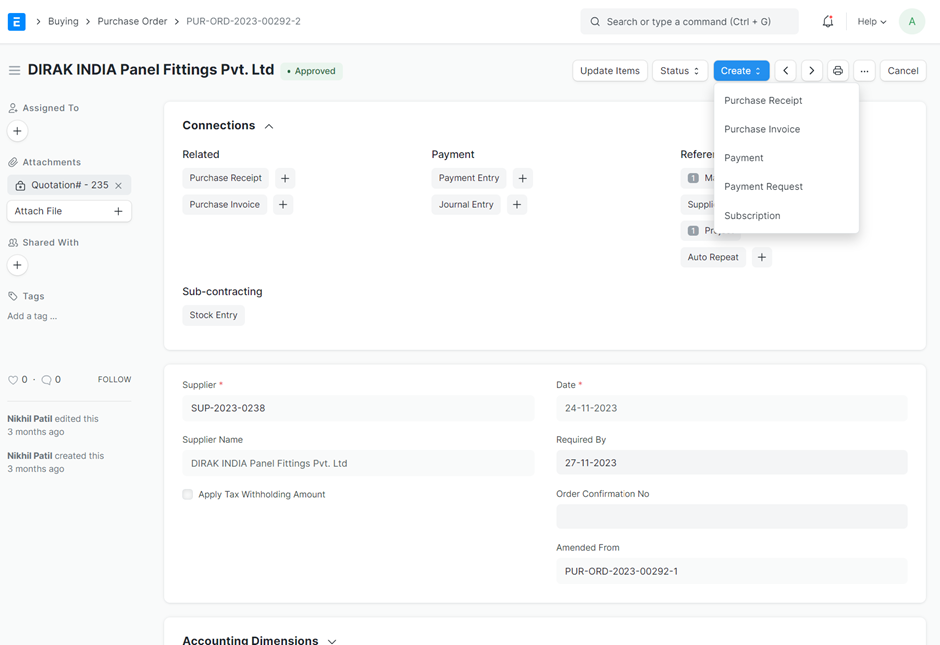

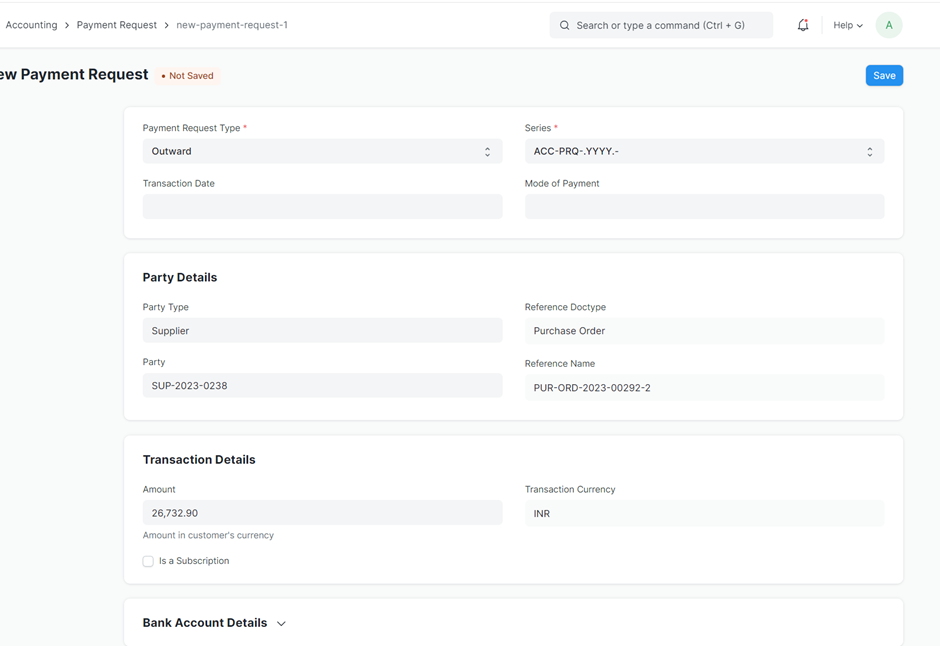

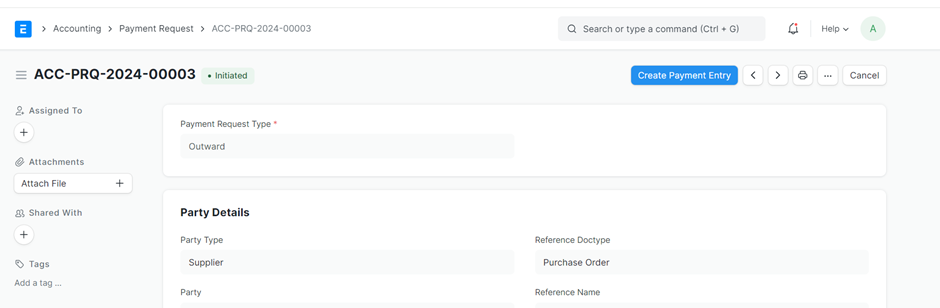

3. Payment Request: Payment Request can happen when ever a payment is made even before Purchase Receipt / Purchase Invoice. This mostly will be for the Advance Payment with respect to Purchase Order or Employee Advances. Payment Request option is available from Purchase Order screen. Payment Request can also be made for overdue Invoices.

These advance payment request has to be processed based on Proforma Invoice provided by the Supplier in order to ensure all terms and conditions are adhered as per Purchase Order. Work flow for Payment Request can be configured for getting approval from competent authority.

Payment entry can be created from the Payment Request.

Custom Development for Payment Process:

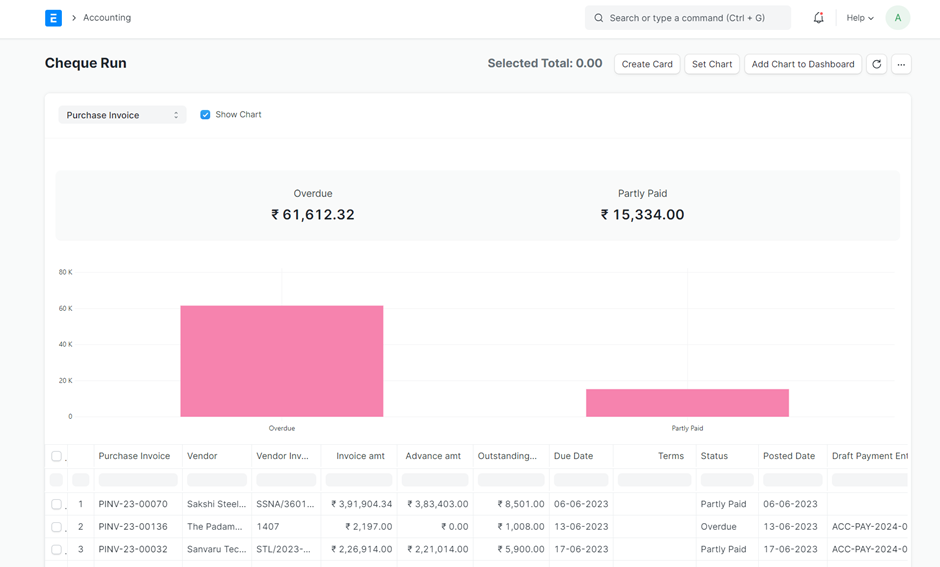

A major challenge in payment process is monitoring and making multiple payments across suppliers. Also option for cash flow insight has to be provided. In order to enable these aspects, Custom development report Cheque Run is implemented.

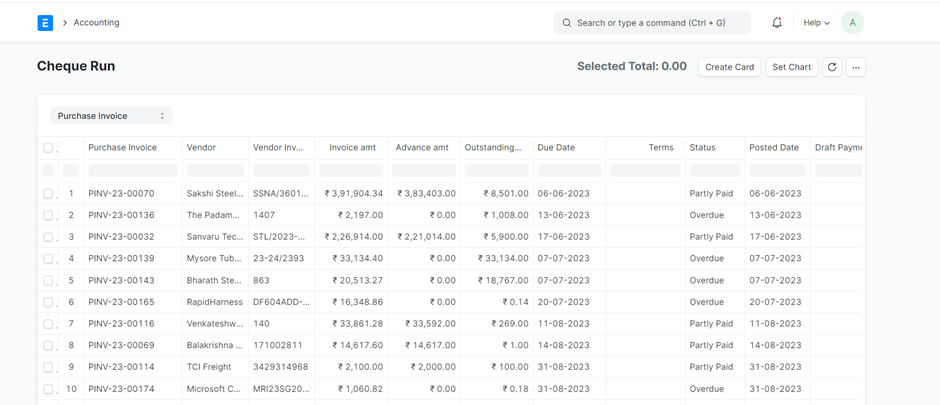

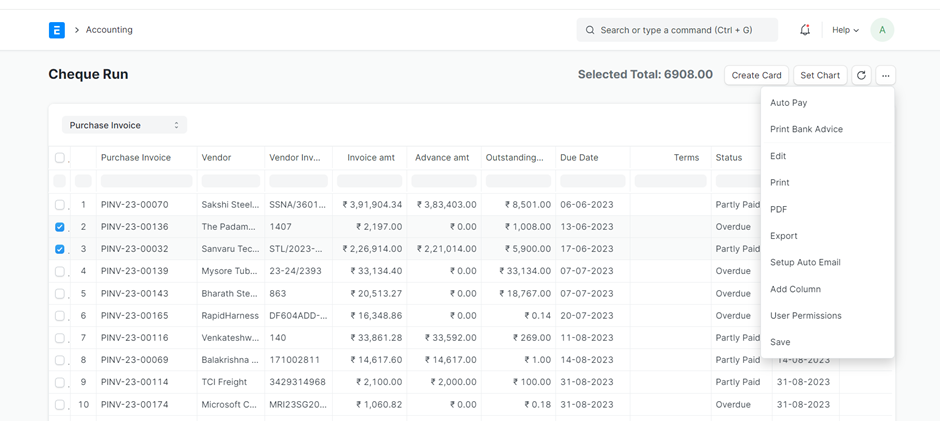

This report gives a over view of pending payments for a given selection viz Purchase Invoice, Expense Claim, Payment Request as shown below:

1. Purchase Invoice : In the case of Purchase Invoice, all records where outstanding amount exist is indicated after considering previous payments/ Advance Payment made. Report also has status and due date information.

On selecting multiple lines, total outstanding amount is indicated.

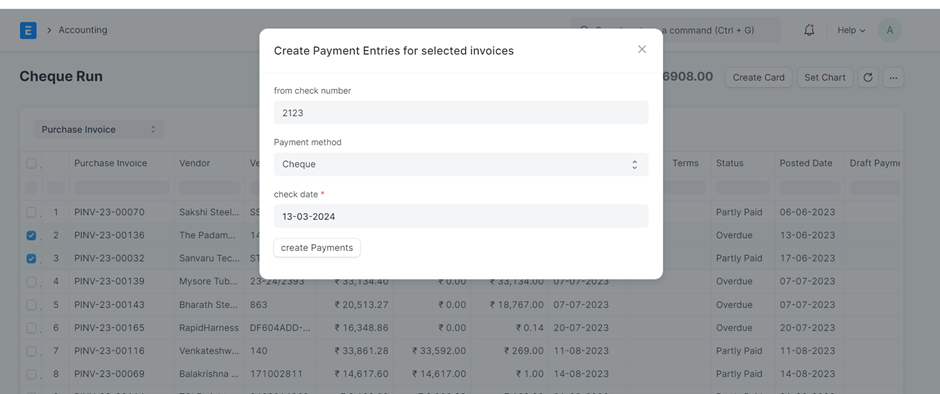

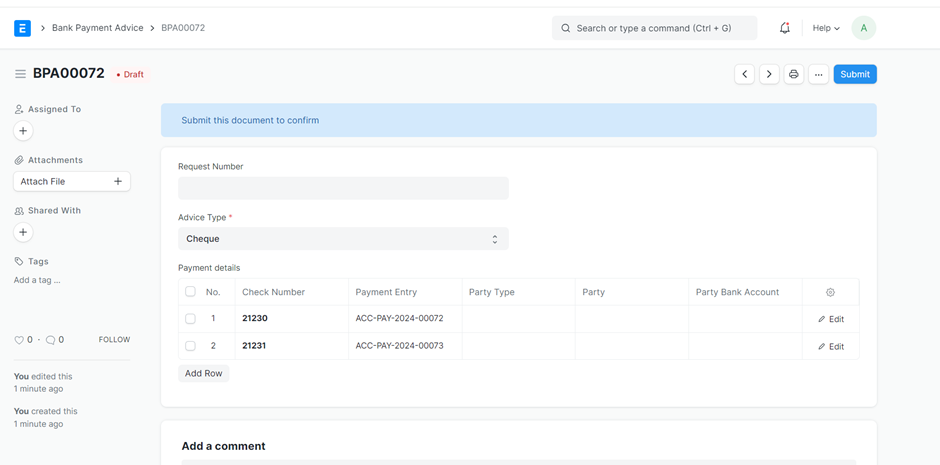

Auto Pay option will create separate payment entry for each supplier. You have the option for entering the cheque number if cheque payment. Subsequent series of cheque numbers will be generated automatically. The system also generates Bank Transfer Advice document with receipient name and respective account information maintained in the system.

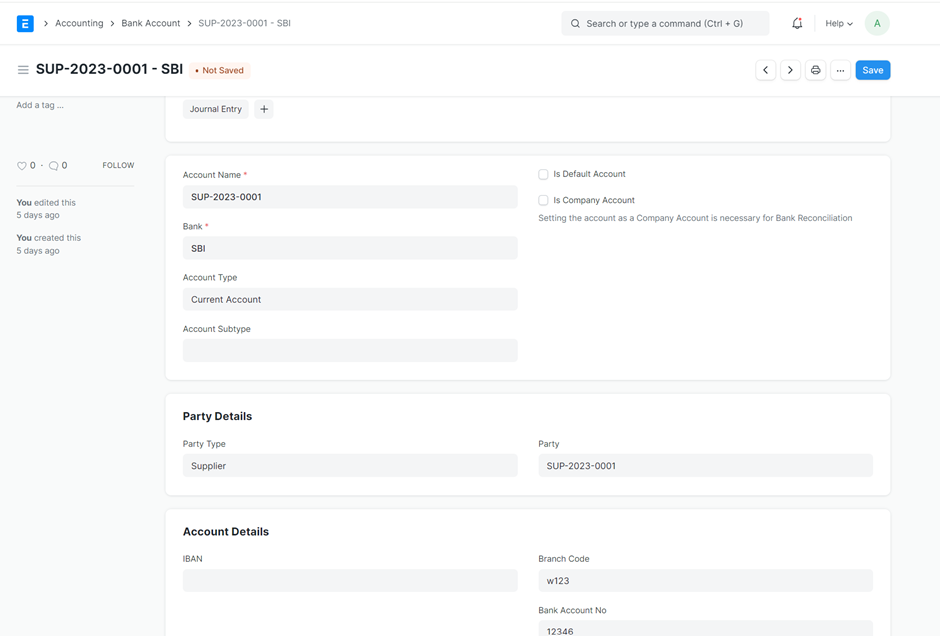

Print out of the Bank Payment Advice can be digitally signed and sent to Bank. Care should be taken to update Bank account details in the system as shown below based on letter from competent authority from the Supplier which can be attached to the document.

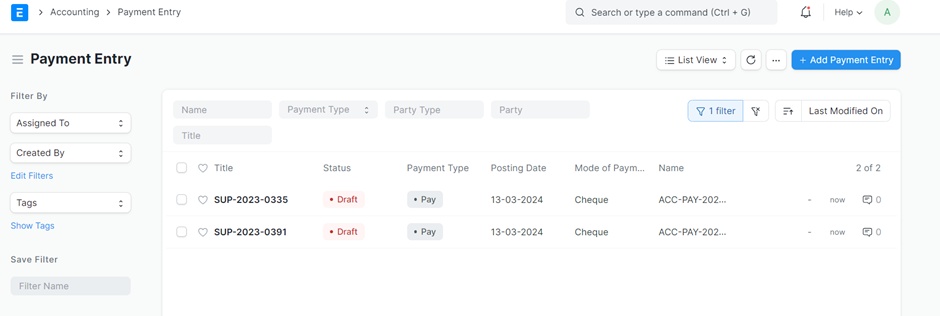

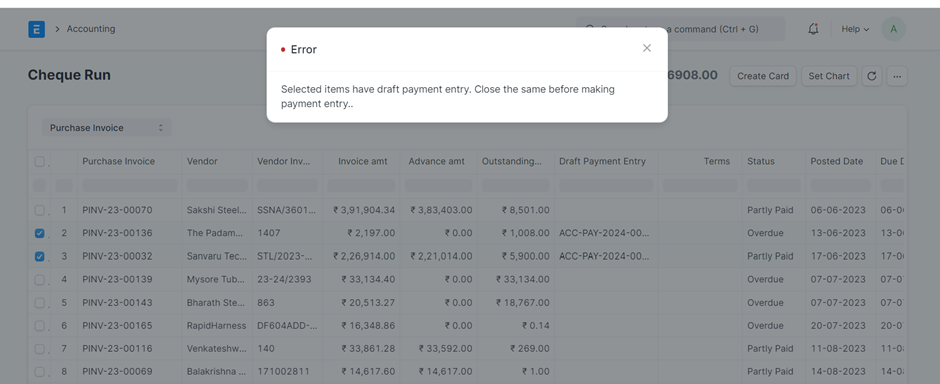

On returning back to Cheque Run report and refreshing the screen, the draft Payment Entry will be visible. The system will not allow to make payment again for the record until the Payment Entry is submitted. If no further outstanding amount is there, the said record will not appear.

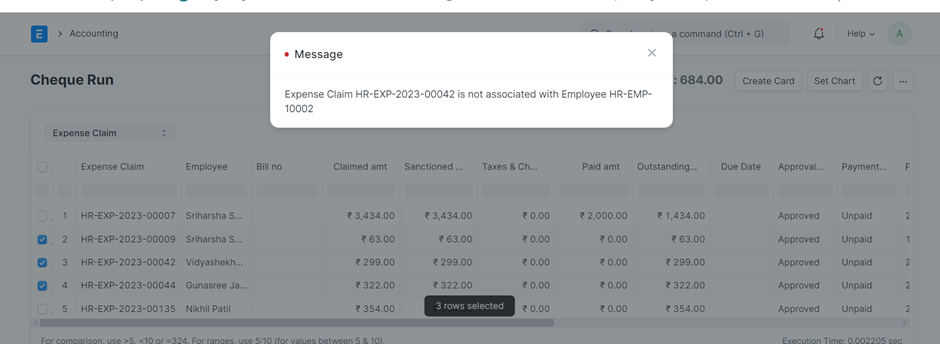

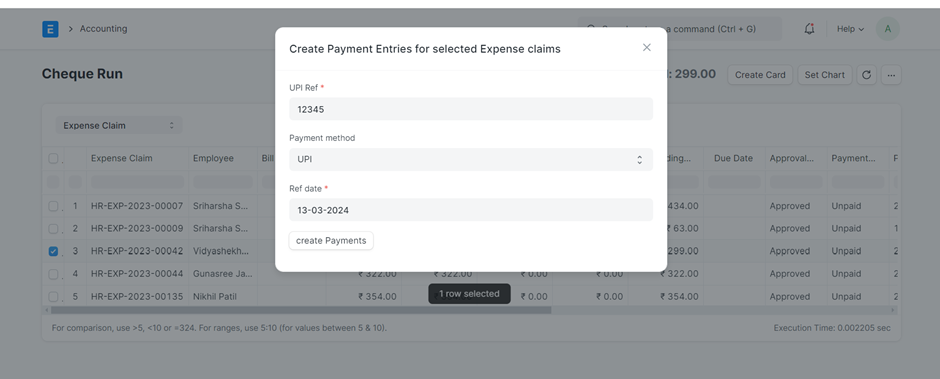

2.Expense Claim: Here again all pending approved expense claim where outstanding amount exist gets listed with other details. The payment process is similar but the system will check if the selected records have same employee before allowing payment. Here the system is configured for updating the single UPI payment reference for multiple expense claim from same employee.

A report can also be exported for pending expense claims.

No comments yet. Login to start a new discussion Start a new discussion